Managements View : *Cement

prices steady in April & May 2018 vs Q4FY18

*Expect

a regular cement price cut of 3%/5% during monsoon

*FY19 tgt vols=3.2mt & EBITDA exp at apprx

900/tn

*Blended costs of borrowing down to 10.75% vs

15.5% earlier

*Capacity wil double by March 2020

( Source : CNBCTV18 )

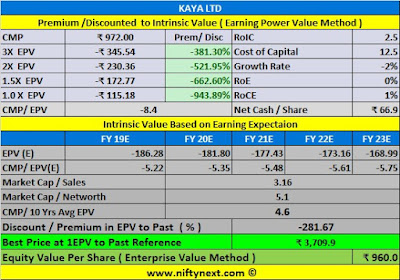

Valuations

: Sanghi

Industries Ltd is now Trading at 2.3X of its EPV ( March 2018 earnings ). Its

10 years avg. long term EPV comes at 3.3X, which translates its effective price

at ₹ 123.50. It

has Net Cash / Share of ₹ 0.70. Market Cap / Networth is 1.9X.

Financials : https://www.screener.in/company/SANGHIIND/

Disclaimer

: We are / may going to take exposure shortly.

Join Us at WhatsApp:

1. https://chat.whatsapp.com/6LfcMS38vjdFt5xYGwS73J

( Free )

2. https://chat.whatsapp.com/8sR3MYOXvSFIIa56Tc7Ush (Premium )

$$$ We are active at Twitter # NIFTYNEXT1

2. https://chat.whatsapp.com/8sR3MYOXvSFIIa56Tc7Ush (Premium )

$$$ We are active at Twitter # NIFTYNEXT1