Wednesday, February 28, 2018

Uniinfo Telecom IPO

Business Description - Uniinfo Telecom Services operates in the telecom

industry with players ranging from telecom equipment manufacturers (OEM’s) to

telecom operators. The company offers support services and solutions to address

the Network Life Cycle requirements of Telecom industry. Over the years, it has

successfully implemented various projects. Uniinfo Telecom Services’ portfolio

includes Network Survey and Planning, Installation and Commissioning, Network

Testing and Optimization, In Building Solutions and WiFi and Managed Services

for network maintenance. Its strong technical background enables it to

effectively carry out end-to-end services thereby covering the entire Network

Roll out map.

Promoters– Kishore Bhuradia, Pranay Parwal, Anil Kumar Jain

Subscription Dates: 5 - 7 March 2018

IPO Price band: INR55 per share

Financials &

Valuations : https://pkamc-my.sharepoint.com/:x:/g/personal/niftynext_myoffice365_site/ESBxKfCF-HdPsKp6hN2fRMIBD9uaeY6gbrJPxSTNEtEfUA?e=dfTOsQ

Tuesday, February 27, 2018

H.G Infra Engineering Ltd.-IPO

About the Company : H.G Infra Engineering Ltd.is

pre-dominantly engaged in the engineering, procurement and construction (EPC)

services of road projects. Currently, more than 90% of the business is coming

from Maharashtra and Rajasthan. The company's order book has grown at a

phenomenal pace of 114% compounded annual growth rate (CAGR) from FY15 to FY17.

With a track record of delivering projects on, the company has received bonuses

for early execution of projects.Financials : Its revenue and bottomline has grown

at a CAGR of 34.3% and 37% respectively from FY13 to FY17. The return ratio's

too have been far better as compared to the peers. The return on equity (RoE)

and return on capital employed (RoCE) has averaged 19.6% and 40% respectively

in the preceding four years.The debt equity ratio at 0.9 in FY17 is in

check and is set to go down as the company will pre-pay the loans from the IPO

proceeds. This can lower the finance cost too in future.

Sun shine in Road Sector: It is expected that investment in road projects to double to Rs 10.70 trillion over next five years & the share of EPC projects to widen.The Government's focus on improving infrastructure in India, the roads and highways infrastructure sector has high potential for growth and the company's experience and track record in the construction business provides them with a competitive advantage in pursuing future opportunities.

Considering the Financials Strength of H.G Infra Engineering Ltd.’s Balance Sheet ie. ROE, ROCE & Debt to Equity Ration, we may Subscribe the IPO.

Sun shine in Road Sector: It is expected that investment in road projects to double to Rs 10.70 trillion over next five years & the share of EPC projects to widen.The Government's focus on improving infrastructure in India, the roads and highways infrastructure sector has high potential for growth and the company's experience and track record in the construction business provides them with a competitive advantage in pursuing future opportunities.

Considering the Financials Strength of H.G Infra Engineering Ltd.’s Balance Sheet ie. ROE, ROCE & Debt to Equity Ration, we may Subscribe the IPO.

Financials : https://pkamc-my.sharepoint.com/:x:/g/personal/niftynext_myoffice365_site/Ef23LXlx7q9OjnemqHkBgusBZhg1DhJ3Qvh3ob08F_yKOg?e=Kp2Vns

Nifty Next : Nifty Future Trading Range on Tuesday 27.02.2018

Nifty-F closes

at ₹ 10600.50

with a Gain of +0.9% on 26.02.2018 with formation of a Green

Candle. We are expecting that Nifty-Future will trade with Flattish note within the Range of

10601-10641. We have Nifty Mid-Term

Support/ Resistance at 9500/11700 for the next 6 months.

Join Us at WhatsApp:

Monday, February 26, 2018

Indian Economy Forecast & Sector Specific Trigger

1.During the period 2018-2022, There will be a

Decline in the Coal Import.

2.We will see Huge activity in Export/Import of

Chemicals & Automotive/Ancillaries in 2018-2022.

3.Iron Ore Production & its import will

increase in 2018-2022.

Getbhavcopy version 2.1.11a Released

Getbhavcopy can download

daily and historical EOD data for Equities, Indices and Futures. The downloaded

data is exported in a format that can be easily imported by leading technical

analysis softwares like Metastock, Amibroker and Fcharts.

Link: https://github.com/hemenkapadia/getbhavcopy/releases/tag/2.1.11a

Getbhavcopy can download

daily and historical EOD data for Equities, Indices and Futures. The downloaded

data is exported in a format that can be easily imported by leading technical

analysis softwares like Metastock, Amibroker and Fcharts.

Link: https://github.com/hemenkapadia/getbhavcopy/releases/tag/2.1.11a

Sunday, February 25, 2018

Pesticide Management Bill-2017 & Sector Outlook

The Centre has

released a new draft Pesticide Management Bill 2017 to replace an almost 50-year old legislation governing

the plant chemicals sector. Main points are as below:

11.pesticide inspectors should also be held

responsible for growth and approval of spurious pesticide, which the new draft

hasn’t incorporated.

2.data protection be extended to five years and

data submitted with application to not be reused by another applicant for three

years, which the current draft does not have.

3. every pesticide sold to a farmer, producer,

stockist, distributor, retailer or pest control operator, as the case may be,

shall disclose the expected performance, efficacy or safety of such pesticide

under given conditions.

4.And, if the pesticide fails to provide the

expected performance or causes any harm to human or animal health or damage to

the environment by use of that pesticide, then, the farmer or the affected

person may claim compensation from the manufacturer or distributor or stockist

or retailer or pest control operator, as the case may be, under the provisions

of the Consumer Protection Act.

All these mesarures will adversely affect the

Pesticides companies.

Resources of this article : Business Standard

Thursday, February 22, 2018

Tractor Sales Growth to Moderate in FY19

Central Statistics Office’s (CSO) advance estimates suggest gross value added of ‘agriculture, forestry and fishing’ would fall to 2.1% in FY18 (FY17: 4.9%), primarily due to the uneven spread of rainfall leading to lower kharif and rabi crop yield and affecting farmers’ cash generation. Higher delinquencies for tractor loans also show the continued stress in the agricultural sector. As around 45% of the total tractor sales are financed through organised channels, loan delinquency rightly represents the average credit profile of a farmer; which might worsen in case of inadequate monsoons in FY-2019, thus impacting the additional demand for tractors.

Wednesday, February 21, 2018

Textile Sector ( Export Based ) : Underpeformer

Textile Sector ( Export Based ) will not perform in the 2018-2021. Avoid these. There is shifting from Malls to e-marts in foreign countries with lesser profit margin.PAT will see ~3/4% down slide.

Join Us at WhatsApp: 1 . https://chat.whatsapp.com/BkfsuTmAwUnBnKY1yh3nWE ( Free )

Join Us at WhatsApp: 1 . https://chat.whatsapp.com/BkfsuTmAwUnBnKY1yh3nWE ( Free )

Why I have been advocating in past for Nifty Target ~9450

In various social network , I was advocating for Nifty to fall & touch the realistic level of ~9450. Here below ( Link shared ), to find an article with similar work-out on why Nifty at 9400.

LINK: http://www.business-standard.com/article/opinion/nifty-unlikely-to-deliver-positive-returns-for-two-years-118022100009_1.html

LINK: http://www.business-standard.com/article/opinion/nifty-unlikely-to-deliver-positive-returns-for-two-years-118022100009_1.html

Tuesday, February 20, 2018

Dhampur Sugar Mills Ltd ( DHAMPURSUG )-A MultiBagger, Buy/Sell/Hold, Growth Prospects and Recommendation, News and Results, Target Price and Analysis, Views and Outlook, Hot Stocks/Picks

DHAMPURSUG closes at ₹ 208.75 with a Gain of + 1.70 %

% on 20-Feb-2018 with formation

of a Green Candle on Daily

Price Chart. Technically, DHAMPURSUG has

entering into a Long Term Bullish Trend. Major Momentum Indicators

are showing Strength on Daily Price Chart. Our NNI index has

also turned Positive.

We may

BUY / Accumulate DHAMPURSUG at CMP

Target

: ₹ 240-270

Stop:

Loss : ₹197

Time

Frame: 1-4 Months

Financials

: https://www.screener.in/company/DHAMPURSUG

Disclaimer : We are / may going to take

exposure shortly.

Monday, February 19, 2018

Rail Transportation : Remote monitoring & diagnostics capability

As We belong to the Equity Investment community & finding a new theme to invest in the new area is always a Yoooo....

Below we are sharing the Youtube link to see how the India Railways is changing the way of Rail Transportation & definatley we will find some gems.

https://www.youtube.com/watch?time_continue=124&v=1Pt0UzCSV44

2. https://chat.whatsapp.com/DZKa9EpkyTF5bpvGwNvzeK ( Premium )

Below we are sharing the Youtube link to see how the India Railways is changing the way of Rail Transportation & definatley we will find some gems.

https://www.youtube.com/watch?time_continue=124&v=1Pt0UzCSV44

2. https://chat.whatsapp.com/DZKa9EpkyTF5bpvGwNvzeK ( Premium )

Sunday, February 18, 2018

FII Investment Data : Sectorwise Investment 15-31 Jan 2018

FII are now Selling in the Indian Equity market. We are uploading the FII Investment Data ( Sectorwise ) from 15-31 Jan 2018.

Link : https://pkamc-my.sharepoint.com/:x:/g/personal/niftynext_myoffice365_site/ETWiyydFae1NjQnLO8xL51EB95DwsDeW9L8Fl9F-zdit_g?e=AjynDj

2. https://chat.whatsapp.com/DZKa9EpkyTF5bpvGwNvzeK ( Premium )

Link : https://pkamc-my.sharepoint.com/:x:/g/personal/niftynext_myoffice365_site/ETWiyydFae1NjQnLO8xL51EB95DwsDeW9L8Fl9F-zdit_g?e=AjynDj

2. https://chat.whatsapp.com/DZKa9EpkyTF5bpvGwNvzeK ( Premium )

Siemens Ltd ( SIEMENS )-A MultiBagger, Buy/Sell/Hold, Growth Prospects and Recommendation, News and Results, Target Price and Analysis, Views and Outlook, Hot Stocks/Picks

SIEMENS closes at ₹ 1267.60 with a Gain of + 0.7 % on 16-Feb-2018 with formation of a Green Candle on Daily Price Chart. Technically, SIEMENS has entering into a Long Term Bullish Trend. Major Momentum Indicators are showing Strength on Daily Price Chart. Our NNI index has also turned Positive.

We may

Target

: ₹ 1750-2000

Stop:

Loss : ₹Nil ( Accumulation Basis )

Time

Frame: 6-12 Months

Investment Theme : It’s a leading player in providing

solutions to companies for Automation / digitalization. It will be benefited

from the Digitalisation / Automation of the Indian TEA Industry.

Disclaimer : We are / may going to take

exposure shortly.

Friday, February 16, 2018

Tata Steel Rights Issue & Valuations

Tata Steel has fixed February 1,2018 as the record date

for the right issue and the issue will be open until February 28,2018. The issue comprises

15,53,94,550 crore fully paid-up ordinary shares not exceeding Rs 8,000 crore

at Rs 510 per scrip, and up to 7,76,97,280 crore partly paid-up ordinary shares

not exceeding Rs 4,800 crore at Rs 615.

Fund Application : Tata steel has an

expansion plan with capex of Rs 235 bn over four years, which it can fund with

existing cash flows, a rights issue and some debt. As many distressed steel

assets that are up for sale, it may also bid for it. If it doesn't bid, it may

see its domestic or global rivals gobble them up and grow their share in the

Indian market. With an improved outlook for steel has helped Tata Steel's

performance improvement , But an aggressive bid to grow inorganically could

again land the company in balance sheet troubles..

Valuations : At the current price of Rs 688, Tata Steel is fairly priced at 1.25 times of estimated FY20 book value. So, If you do not own the stock consider buying it only at lower levels.

Valuations : At the current price of Rs 688, Tata Steel is fairly priced at 1.25 times of estimated FY20 book value. So, If you do not own the stock consider buying it only at lower levels.

At the offer

price of Rs 510 for the fully paid shares, the stock offers CAGR of over 15%

per annum over next 2 to 3 years. So, if you are eligible to participate in the rights

issue to apply for the fully paid up shares.

At the offer price of Rs 615 for the partly paid shares, the compounded returns are not attractive even over a period of 2 to 3 years. Hence it is better to avoid this offering.

At the offer price of Rs 615 for the partly paid shares, the compounded returns are not attractive even over a period of 2 to 3 years. Hence it is better to avoid this offering.

Thursday, February 15, 2018

Wednesday, February 14, 2018

Safari Industries (India) Ltd (523025)-A MultiBagger, Buy/Sell/Hold, Growth Prospects and Recommendation, News and Results, Target Price and Analysis, Views and Outlook, Hot Stocks/Picks

Safari Industries (India) Ltd closes at ₹ 535.00 with a Fall of -3.70 % % on 14-Feb-2018 with formation of a Bearish Engulfing Candle on Daily Price Chart. Technically, Safari Industries (India) Ltd has entering into a Long Term Bullish Trend. Major Momentum Indicators are showing Strength on Daily Price Chart. Our NNI index has also turned Positive.

We may BUY

Target

: ₹ 75-800

Stop:

Loss : ₹475

Time

Frame: 6-12 Months

Financials

: https://www.screener.in/company/523025/

Disclaimer : We are / may going to take

exposure shortly.

Join Us

at WhatsApp: 1 . https://chat.whatsapp.com/BkfsuTmAwUnBnKY1yh3nWE (

Free )

2. https://chat.whatsapp.com/DZKa9EpkyTF5bpvGwNvzeK ( Premium )

Tuesday, February 13, 2018

Subscribe to:

Comments (Atom)

Disclaimer

The recommendations made herein do not constitute an offer to sell or a solicitation to buy any of the securities mentioned. No representations can be made that the recommendations contained herein will be profitable or that they will not result in losses. Readers using the information contained herein are solely responsible for their actions. Information is obtained from sources deemed to be reliable but is not guaranteed as to accuracy and completeness. The above recommendations are based on the theory of Technical Analysis and do not reflect the fundamental validity of the Scrip. www.niftynext..com does 't take any Responsibility for any losses arising from using the Stocks Recommendations.

We( WWW.NIFTYNEXT.COM) are not Registered with Any Regulatory Body in India ie SEBI,NSE,BSE,AMFI or Any Otheres.

Blog Archive

-

▼

2018

(269)

-

▼

February

(47)

- Nifty Next : Nifty Future Trading Range on Monday ...

- Vakrangee Ltd - Valuations

- PC Jeweller Ltd - Valuations

- Nifty Next : Nifty Future Trading Range on Tuesday...

- Implied Market-Risk Premium -INDIA

- Tata Motors Ltd : December 2017 Quarterly Financia...

- Nifty Next : Nifty Future Trading Range on Tuesday...

- Signet Industries Ltd : December 2017 Quarterly Fi...

- BSE, NSE may soon stop trading of their indices in...

- Indian bourses to stop licensing index, stock pric...

- SGX Nifty Will Trade as Normal

- IPO : Aster DM Healthcare- Financials

- Nifty Next : Nifty Future Trading Range on Monday ...

- Vivimed Labs Ltd ( VIVIMEDLAB )-A MultiBagger, Bu...

- KRBL Ltd ( KRBL )-A MultiBagger, Buy/Sell/Hold, G...

- Nandan Denim Ltd ( NDL )-A MultiBagger, Buy/Sell/H...

- Advani Hotels & Resorts (India) Ltd- Quarterly Res...

- Vertoz Advertising Ltd-Quarterly Results Update

- Safari Industries (India) Ltd (523025)-A MultiBagg...

- Sonata Software Ltd- Quarterly Results Update Dec-...

- Punjab National Bank- Share Valuations

- Gitanjali Gems Ltd- Equity Valuations

- PUNJAB NATIONAL BANK: Networth after the Mess

- Tata Steel Rights Issue & Valuations

- A cumulative view of all the Q3FY18 results announ...

- Siemens Ltd ( SIEMENS )-A MultiBagger, Buy/Sell/Ho...

- FII Investment Data : Sectorwise Investment 15-31...

- AmiBroker 6.28.0 BETA

- Rail Transportation : Remote monitoring & diagnost...

- Samrat Pharmachem Ltd-Quarterly Results Update Dec...

- GALA GLOBAL PRODUCTS LTD-Quarterly Results Update ...

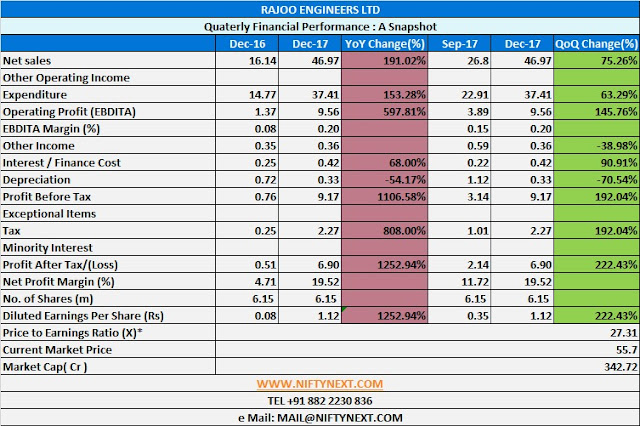

- Rajoo Engineers Ltd-Quarterly Results Update Dec-2017

- Dhampur Sugar Mills Ltd ( DHAMPURSUG )-A MultiBagg...

- Why I have been advocating in past for Nifty Targe...

- Textile Sector ( Export Based ) : Underpeformer

- Pasupati Acrylon Ltd-Quarterly Results Update Dec-...

- Tractor Sales Growth to Moderate in FY19

- HDFC Standard Life: Business Data For Jan 2018

- Pesticide Management Bill-2017 & Sector Outlook

- Getbhavcopy version 2.1.11a Released

- Indian Economy Forecast & Sector Specific Trigger

- Vadivarhe Speciality Chemicals Ltd ( VSCL )- Finan...

- Nifty Next : Nifty Future Trading Range on Tuesday...

- H.G Infra Engineering Ltd.-IPO

- Stocks which are bought by Management in 2018

- Uniinfo Telecom IPO

- Stocks which are bought by Management in on 28 Feb...

-

▼

February

(47)